FinOpX

Smarter onboarding and lending, built on Salesforce

FinOpX is an all-in-one digital platform built on Salesforce, designed to transform how financial institutions manage lending, onboarding, collections, and CRM. With intelligent automation, AI/ML-powered underwriting, and seamless integration with KYC, OCR, and third-party APIs like Karza and Twilio, FinOpX accelerates customer journeys across channels. From bank account openings to credit disbursement and loan origination, the solution streamlines operations, reduces risk, and improves customer experience—making it a game-changer for modern financial services.

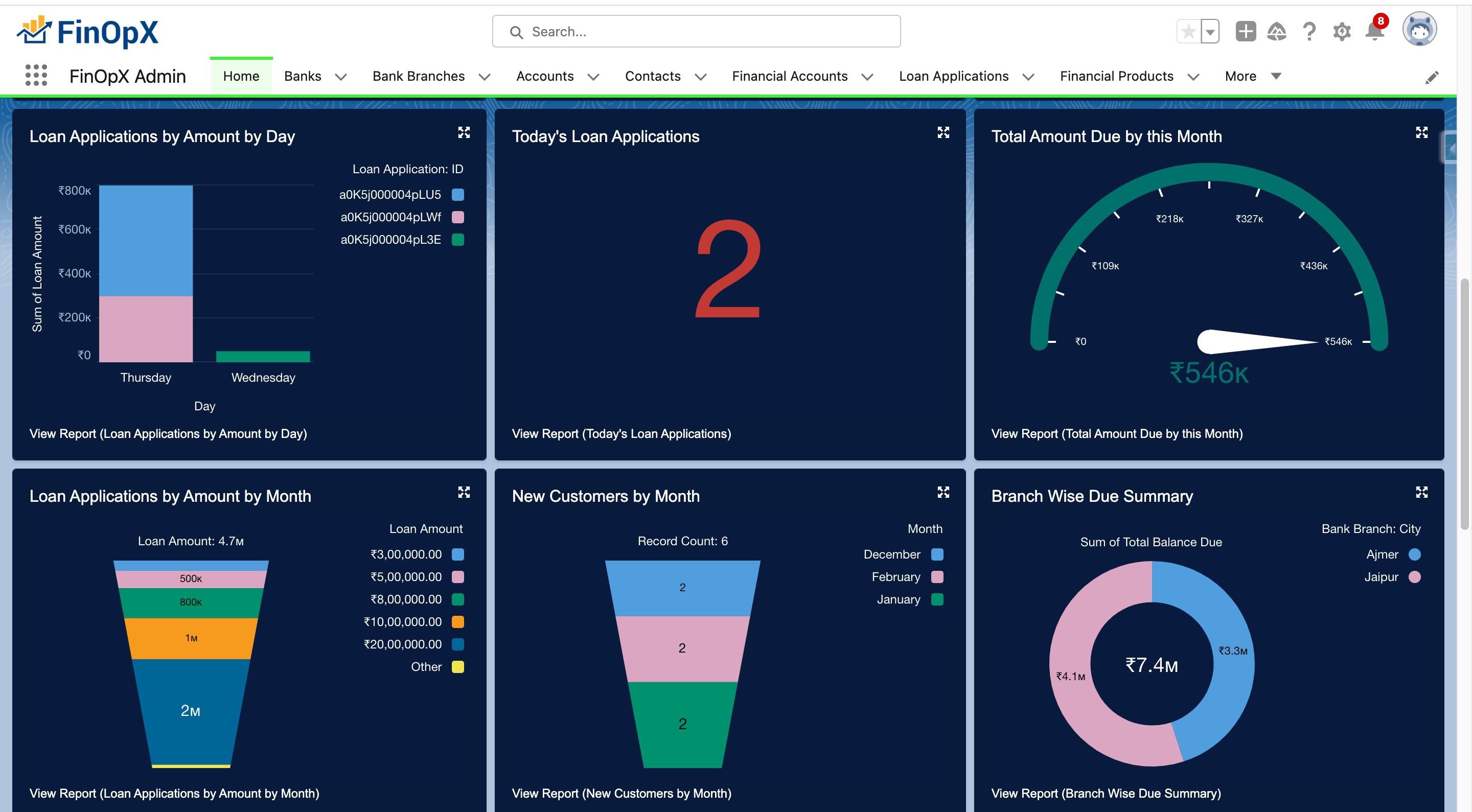

The Business Impact

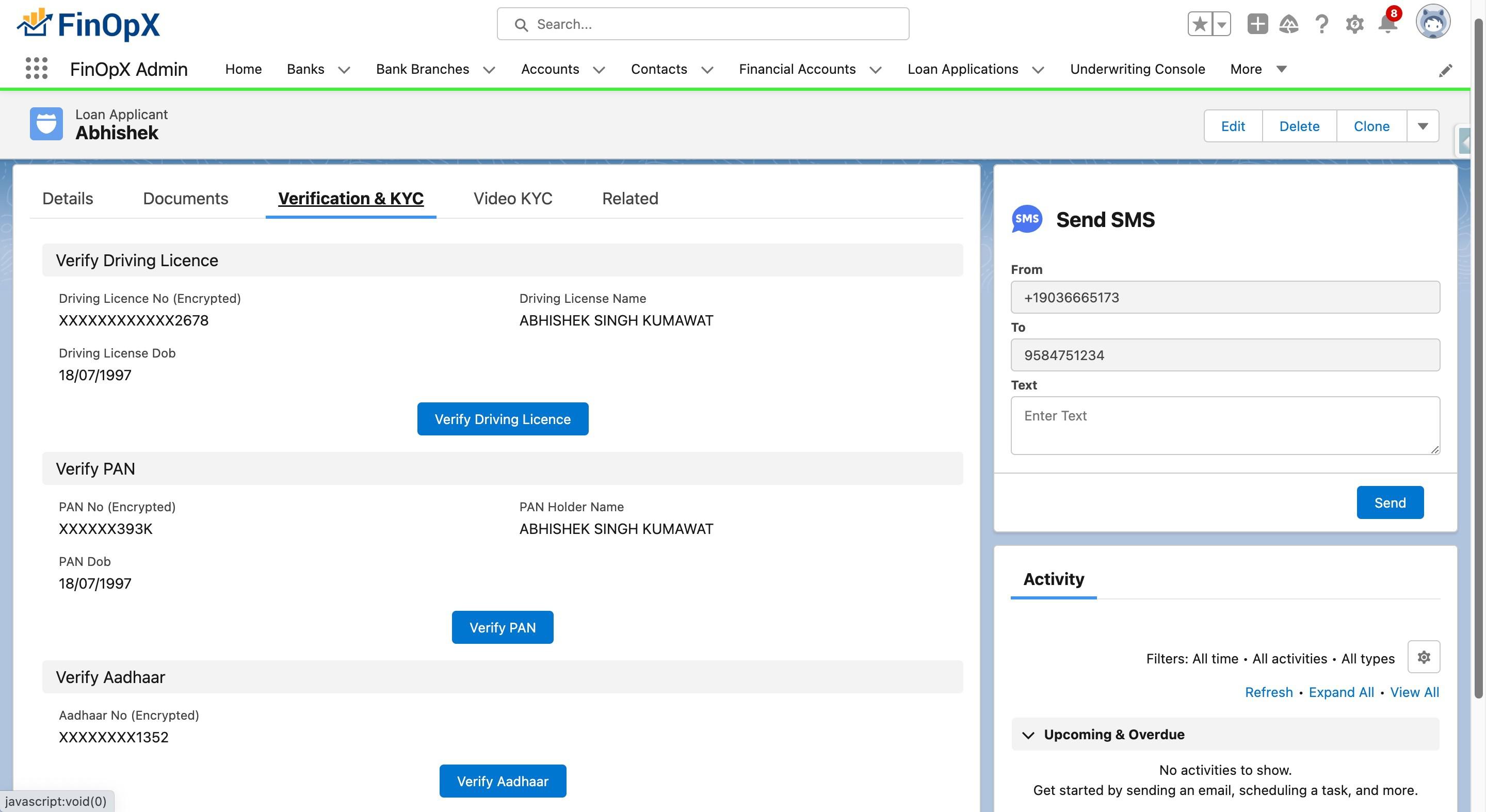

Digital Customer Onboarding

Onboard your customers digitally 10x faster using video KYC.

Faster Decisioning

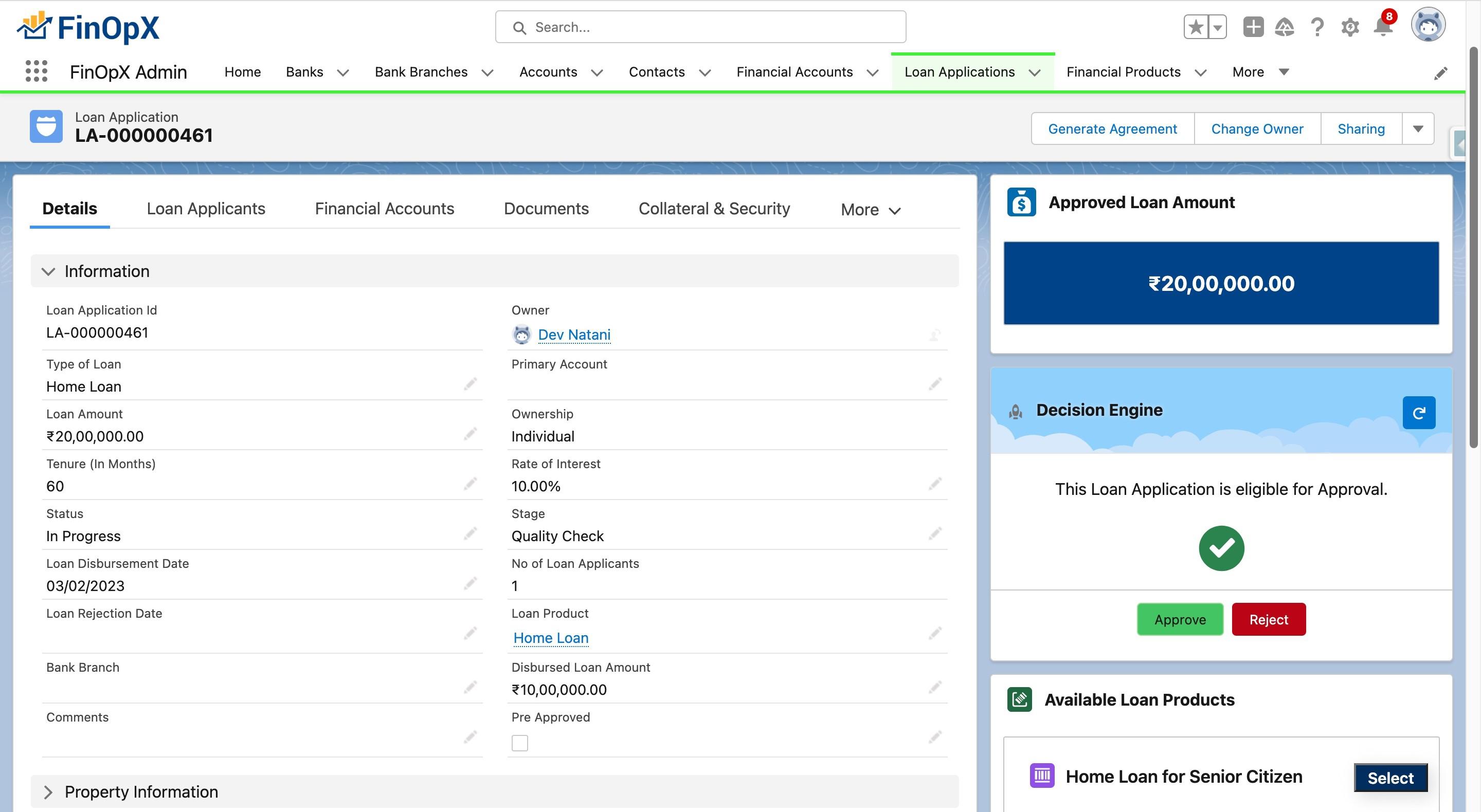

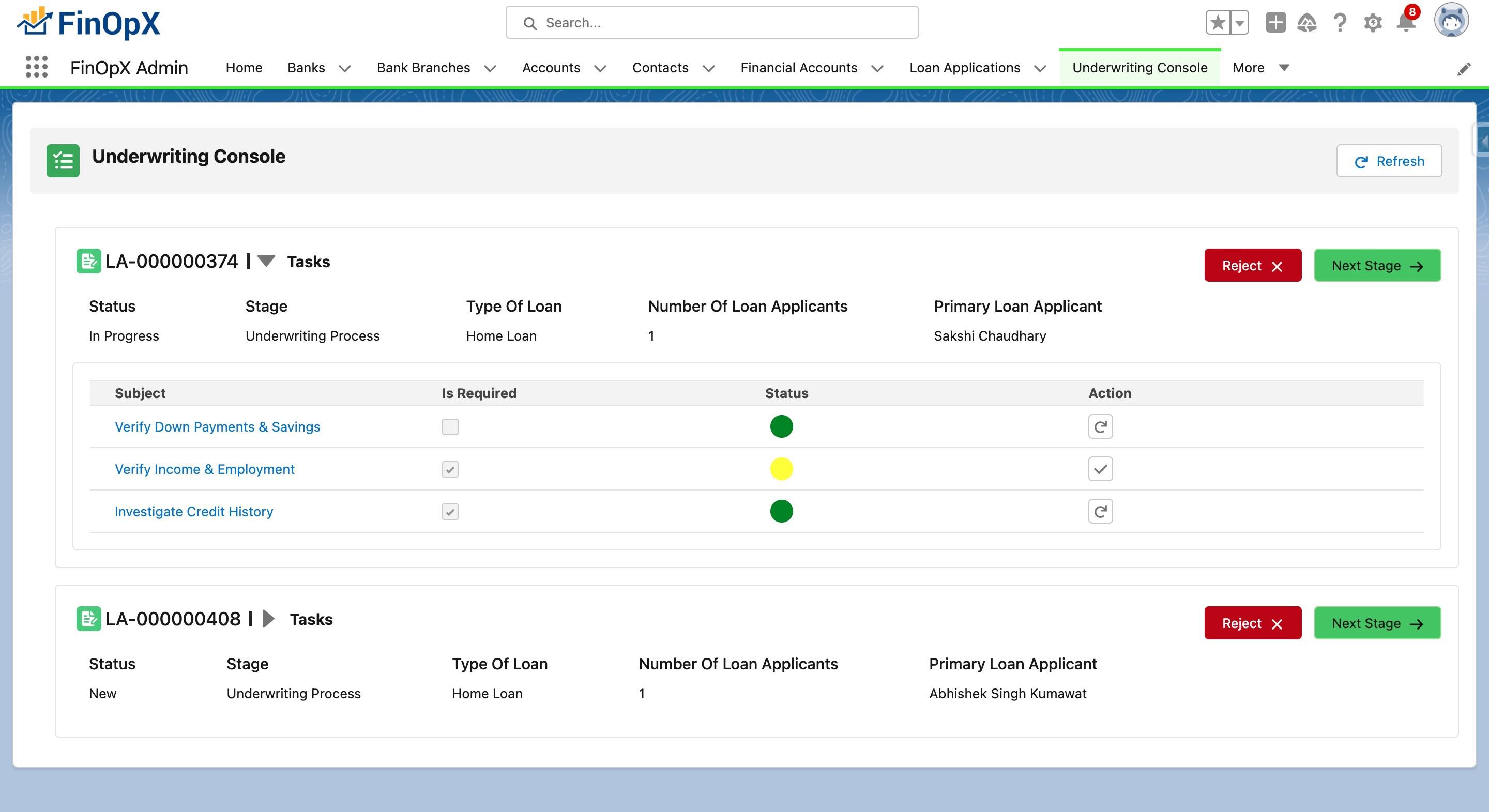

Make automated smart decisions on loan applications with a Dynamic Rule Engine Framework.

360° View of Customer Profile

Give your employees a complete and consolidated view of the customer profile at one place, from offers to transactions, to life events and goals.

Personalized Offers for Customers

Delight your customers with offers recommended by Einstein and Rule Engine.

Simplify Your Payment Process

Effortless EMI collection and timely notifications and reminders.

Key Features

Customer Relationship Management (CRM)

Manage customer accounts, leads, documents, and tasks in one place—driving productivity and personalized engagement across the lifecycle.

Omnichannel Loan Origination

Enable loan applications across digital and offline channels, with automation accelerating approvals and improving accuracy.

Intelligent Customer Onboarding

Automate account opening, credit card issuance, and more—ensuring frictionless customer experiences integrated with core banking services.

Pre-Screening & KYC Automation

Automate pre-screening using KYC, CIBIL, and OCR checks—cutting delays and strengthening fraud prevention.

AI-Powered Risk & Underwriting

Use AI and ML for dynamic risk models and underwriting processes, delivering faster, data-driven loan decisions.

Collateral & Payment Management

Track collateral, manage financial accounts, and automate payment reminders to improve collections and reduce defaults.

Collections Planning & Execution

Plan and track field visits for collections with structured workflows, improving recovery rates and operational efficiency.

Real-Time Analytics & Reporting

Access intuitive dashboards and reports on key metrics—EMI overdues, loan status, collections, customer trends, and more—to support informed decision-making.

See It In Action

Contact

Let’s discuss how we can support your journey.